Introduction

Auto insurance is a crucial aspect of responsible vehicle ownership. Whether it’s for personal or commercial use, having the right insurance coverage protects against unforeseen circumstances. In this comprehensive guide, we’ll delve into the distinctions between commercial and personal auto insurance, helping you make informed decisions.

I. Overview of Auto Insurance

Auto insurance is a contractual agreement between a vehicle owner and an insurance company. Its primary purpose is to provide financial protection in the event of accidents, theft, or other covered incidents. In many places, having auto insurance is a legal requirement.

II. Personal Auto Insurance

Personal auto insurance is designed for individuals and families. It typically includes coverage options such as liability, comprehensive, and collision. Liability coverage pays for damages to others if you’re at fault in an accident, while comprehensive and collision coverage protect against non-collision events and collisions, respectively.

Factors influencing personal auto insurance rates include driving record, age, and location. For example, a driver with a clean record may qualify for lower premiums, while younger drivers or those in high-traffic areas might face higher rates.

III. Commercial Auto Insurance

Commercial auto insurance, on the other hand, is tailored for businesses that use vehicles for work purposes. This could include delivery trucks, service vehicles, or any other vehicles owned or used by a business. Coverage options vary but can include liability, physical damage, and coverage for employees using their vehicles for business purposes.

The rates for commercial auto insurance are influenced by factors such as the type of business, the number of vehicles, and the purpose of vehicle use.

IV. Key Differences Between Commercial and Personal Auto Insurance

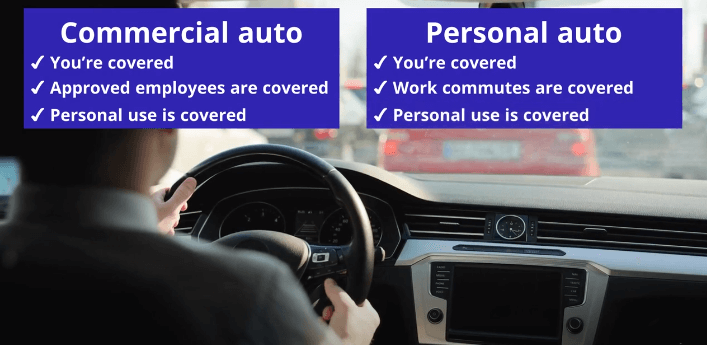

a. Coverage Variations

The most significant difference lies in the coverage provided. Commercial auto insurance tends to have higher coverage limits since businesses often face more significant risks. Personal auto insurance is generally more straightforward and may not cover business-related activities.

b. Premium Calculation

The calculation of premiums also differs. Personal auto insurance premiums are often based on personal factors like driving history and credit score. Commercial auto insurance premiums consider business-related factors, such as the type of industry and the purpose of vehicle use.

c. Eligibility and Requirements

Eligibility for these types of insurance also varies. Personal auto insurance is straightforward, while commercial auto insurance may have more stringent eligibility criteria, especially for certain industries.

V. Choosing the Right Type of Insurance

Choosing the right type of insurance depends on various factors. For individuals, personal auto insurance is the standard choice. However, businesses must carefully assess their needs and consider the nature of their vehicle usage.

Case Study: ABC Delivery Services

ABC Delivery Services, a local courier company, faced a dilemma when deciding between personal and commercial auto insurance. After assessing their operations and consulting with an insurance expert, they opted for commercial auto insurance to ensure comprehensive coverage for their fleet used in business activities.

VI. Tips for Cost Savings

Regardless of whether you need personal or commercial auto insurance, there are strategies for saving on premiums.

a. Personal Auto Insurance Savings

- Maintain a clean driving record.

- Bundle auto insurance with other policies.

- Increase deductibles for lower premiums.

b. Commercial Auto Insurance Savings

- Implement driver safety training programs.

- Use telematics devices to monitor and improve driving behavior.

- Regularly review and update your insurance policies to ensure they align with your business needs.

VII. Importance of Properly Insuring Your Vehicles

Having adequate insurance coverage is crucial for financial protection. Inadequate insurance can lead to severe financial repercussions, especially for businesses that rely on vehicles for their operations.

VIII. Frequently Asked Questions (FAQs)

Q: Can I use personal auto insurance for business purposes?

A: Personal auto insurance may not cover business-related activities. If you use your vehicle for work, it’s advisable to have commercial auto insurance.

Q: What factors influence commercial auto insurance rates?

A: Factors include the type of business, the number of vehicles, the purpose of vehicle use, and the driving records of employees.

Conclusion

In conclusion, understanding the differences between commercial and personal auto insurance is essential for making informed decisions. Whether you’re an individual or a business owner, the right insurance coverage ensures protection and peace of mind on the road.